Il Sui Wage Base 2024

Il Sui Wage Base 2024. Effective january 1, 2024, the sui taxable wage base will be $7,000 if the unemployment trust fund balance is more than $600 million as of june 30 of the most. Wage base and tax rates in illinois.

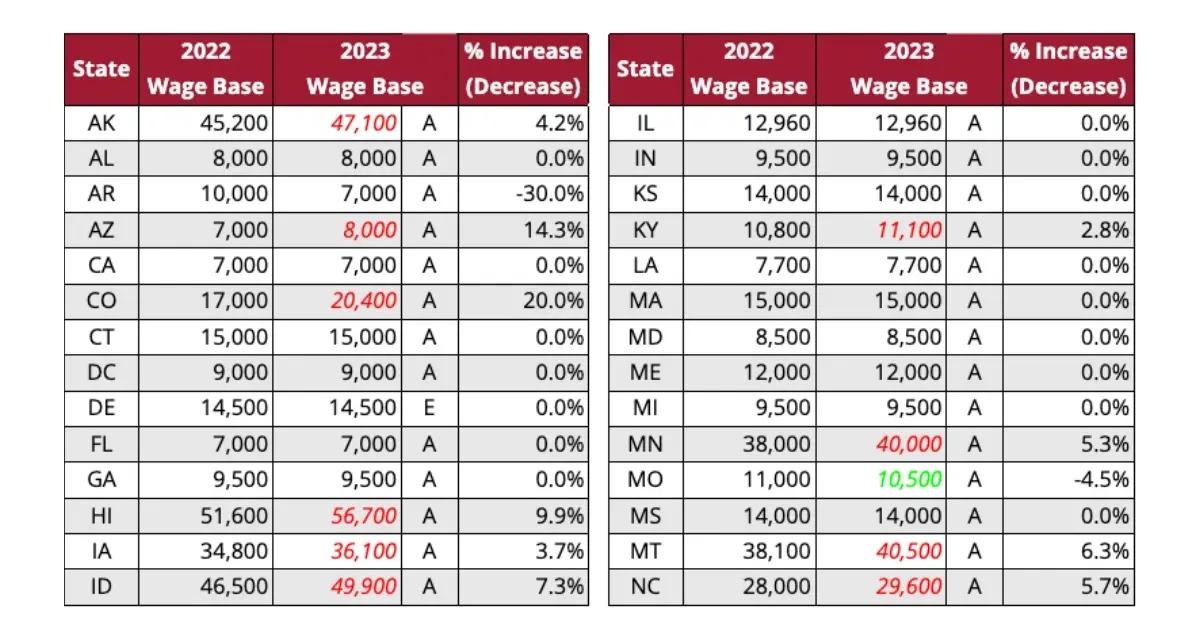

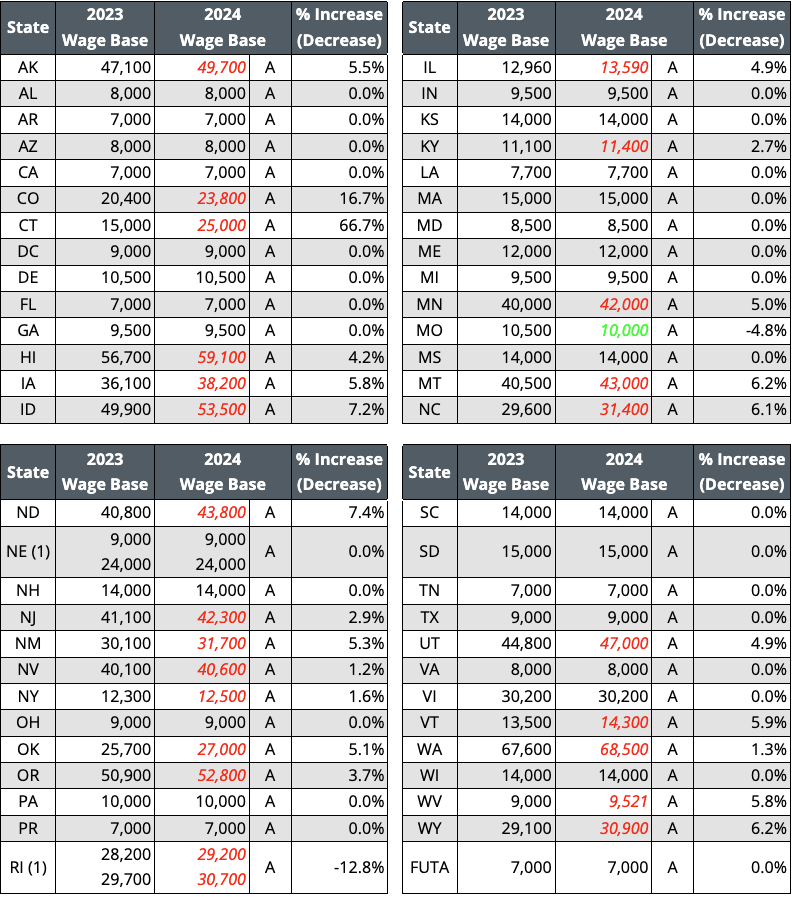

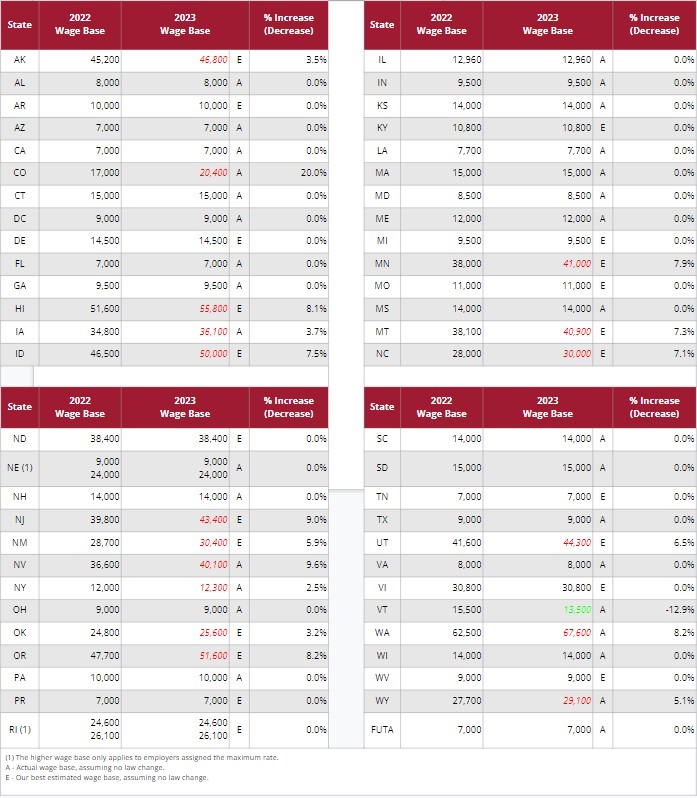

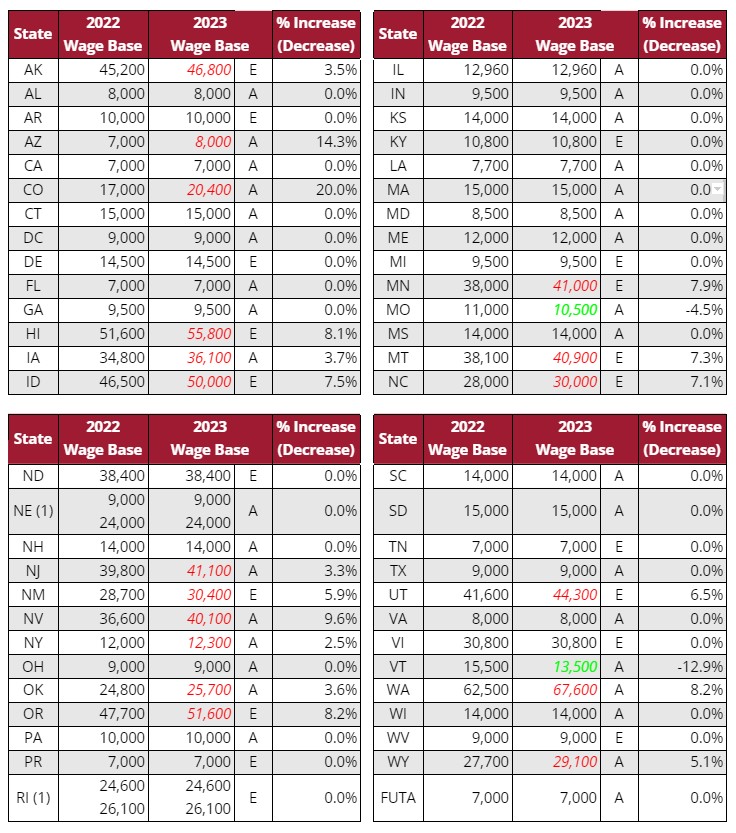

The 2022 sui taxable wage base will be $17,000, then $20,400 in 2023; Check out the updated 2024 federal benefit limits for 401(k), hsa, and simple ira, and more.

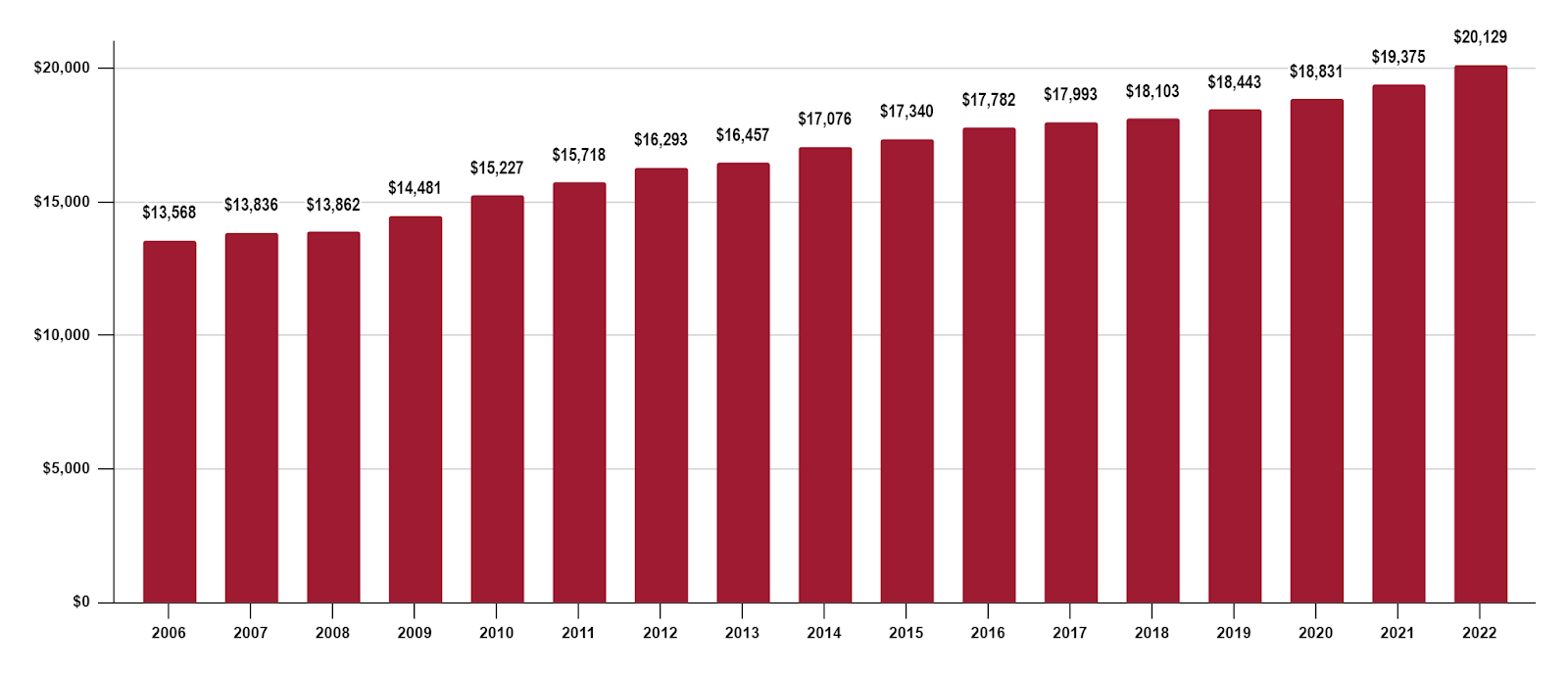

Ui Tax Is Paid On Each Employee's Wages Up To A Maximum Annual Amount.

This is the maximum wage per employee subject to the suta tax.

After 2026, The Taxable Wage Base Will Be Adjusted By Changes In.

Wage base and tax rates in illinois.

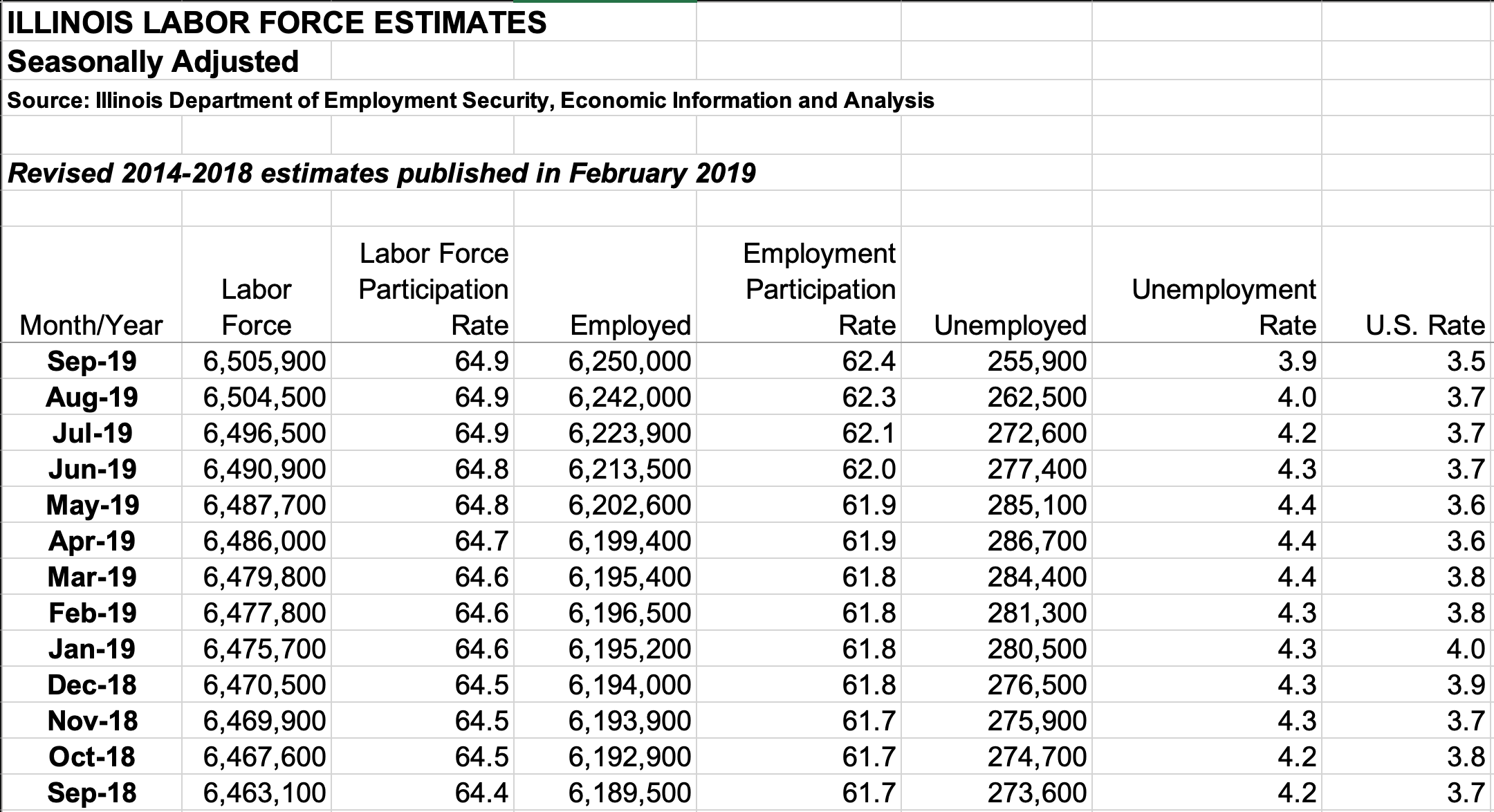

31 Press Release From The Labor.

Images References :

Source: marketrealist.com

Source: marketrealist.com

What Is SUI Tax and Who Pays It? Here's What We Know, 31 press release from the labor. 2024 state unemployment taxable wage bases.

Source: workforce.equifax.com

Source: workforce.equifax.com

Outlook for State Unemployment Insurance (SUI) Tax Rates in 2024 and Beyond, Ui tax is paid on each employee's wages up to a maximum annual amount. Stay informed and plan your finances with confidence!

Source: workforce.equifax.com

Source: workforce.equifax.com

2022 SUI Tax Rates in a PostCOVID World, An updated chart of state taxable wage bases for 2021 to 2024 (as of february 7, 2024) may be downloaded from the payroll.org website. Illinois released its 2024 unemployment insurance tax rate and wage base information in a chart issued by the employment security department.

Source: workforce.equifax.com

Source: workforce.equifax.com

2022 SUI Tax Rates in a PostCOVID World Workforce Wise Blog, This is the maximum wage per employee subject to the suta tax. Check out the updated 2024 federal benefit limits for 401(k), hsa, and simple ira, and more.

Source: news.wsiu.org

Source: news.wsiu.org

Illinois Unemployment Drops To "Record Low," Preliminary Data Shows WSIU, Effective january 1, 2024, hb 3733, which also amended iprra, amends the illinois minimum wage law, illinois equal pay act, illinois wage payment and. The 2022 sui taxable wage base will be $17,000, then $20,400 in 2023;

Source: workforce.equifax.com

Source: workforce.equifax.com

2022 SUI Tax Rates in a PostCOVID World Workforce Wise Blog, The federal unemployment tax act (futa) requires that each state’s taxable wage base must at least equal the futa taxable wage base of $7,000 per. Illinois released its 2024 unemployment insurance tax rate and wage base information in a chart issued by the employment security department.

![Social Security Wage Base 2021 [Updated for 2023] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023-1024x791.png) Source: www.uzio.com

Source: www.uzio.com

Social Security Wage Base 2021 [Updated for 2023] UZIO Inc, An updated chart of state taxable wage bases for 2021 to 2024 (as of february 7, 2024) may be downloaded from the payroll.org website. Effective january 1, 2024, the sui taxable wage base will be $7,000 if the unemployment trust fund balance is more than $600 million as of june 30 of the most.

Source: thepayrolladvisor.com

Source: thepayrolladvisor.com

SUI Wage Bases for 2021 ThePayrollAdvisor, Check out the updated 2024 federal benefit limits for 401(k), hsa, and simple ira, and more. Wage base and tax rates in illinois.

Source: www.aatrix.com

Source: www.aatrix.com

(1) The higher wage base only applies to employers assigned the maximum, An updated chart of state taxable wage bases for 2021 to 2024 (as of february 7, 2024) may be downloaded from the payrollorg website. After 2026, the taxable wage base will be adjusted by changes in.

Source: www.nextep.com

Source: www.nextep.com

2024 SUTA Wage Base Rundown by State Nextep, Click here for an historical rate chart. Illinois house bill 3301 took effect on january 1, 2024, amending illinois’ unemployment insurance act to update the definition of a newly hired employee to.

After 2026, The Taxable Wage Base Will Be Adjusted By Changes In.

Illinois house bill 3301 took effect on january 1, 2024, amending illinois’ unemployment insurance act to update the definition of a newly hired employee to.

Effective January 1, 2024, Hb 3733, Which Also Amended Iprra, Amends The Illinois Minimum Wage Law, Illinois Equal Pay Act, Illinois Wage Payment And.

Check out the updated 2024 federal benefit limits for 401(k), hsa, and simple ira, and more.